If you’re paying attention to business news these days, you’ve likely heard the term “ESG”. The phrase is gaining traction in board rooms, on Wall Street, and in the mainstream. It stands for Environmental, Social, Governance.

But what does that mean and how does it relate to today’s environmental program managers?

Whether you are part of the Fortune 500, privately held company, or a governmental agency— applying ESG principles to your business model can have profound impacts on financial performance, employee retention and satisfaction, and overall success and longevity of your organization.

This blog will help environmental professionals understand the evolution of ESG, the practical implementation of ESG principles, and offer tips on how to get started.

The Evolution of ESG

Socially responsible development, consumerism, and investment started as an idea in the 1960’s, gathered strength with the establishment of the United Nations (UN) Principles for Responsible Investment (PRI) in 2006, identified a set of ideals in the UN’s 17 sustainable development goals (SDGs), and rose to the forefront when the World Economic Forum (WEF) published the Davos Manifesto defining the role of a company in the “Fourth Industrial Revolution”.

Image courtesy of https://www.un.org/sustainabledevelopment/news/communications-material/

As a result of this evolution, sustainability reporting to capture an organization’s impact and progress has grown exponentially, while public commitments of companies and organizations to the UNPRI signatory list have risen from 81 in 2006 to over 5,000 today (UNPRI).

The ideas in the Davos Manifesto coupled with the UN’s SDGs, form a strong framework in which a company’s ESG ideals can be assessed. These concepts have a large footprint in both the consumer and institutional spending, as well as in company board rooms, and development of transparent policy.

Sustainability or ESG?

The terms sustainability and ESG are sometimes used interchangeably. But, it’s important to note the clear distinction.

Sustainability captures an organization’s performance in terms of environmental, social, and economic impact. The process starts on the inside of an organization by evaluating policies, programs, and data. It involves stakeholder engagement and internal analysis to identify the material issues on which to focus efforts. There is an expectation of transparency in goal setting and external reporting.

Sustainability is a framework for making internal capital investments to maximize an organization’s positive impact in the world. It’s equally applicable for business, non-profit, and governmental agencies.

ESG is set of standards external investors use to assess a company’s performance and risk. In contrast to sustainability, it’s a way of evaluating a company from the outside looking in for the purpose of making investment decisions. ESG is most applicable to large, publicly traded companies and is used by banking, financing, and investment sectors. While there are widely accepted ESG frameworks, ESG is not a regulatory requirement.

Each consumer, investor, or company must choose which issues of the framework are material to their circumstance and prioritize accordingly. The WEF and UN developed metrics and sustainability goals to help lead and push businesses into a more responsible and aware 21st century. These metrics help form a baseline for consumers and investors to judge a company’s compliance and attitude towards the ideals of ESG.

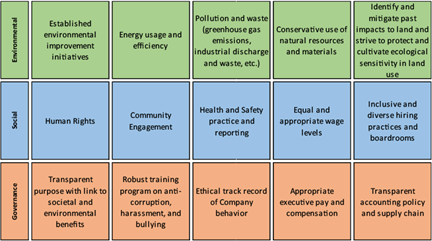

In general, ESG includes the following ideas and concepts:

The above concepts can vary wildly based on interpretation, especially in relation to company performance. To establish a more concrete set of business practices and values, WEF established 21 specific metrics consisting of 4 pillars (WEF, 2020) that could help align corporate performance reporting with ESG. The concepts developed by the WEF and UN were, in essence, created as a response to consumers and investors wanting to implement and screen companies using ESG as a guide.

ESG for Environmental Professionals

Stakeholders are placing more emphasis on sustainability, risk mitigation, and transparency in policy and reporting. It is essential for a company to have programs in place to address these evolving issues. That process doesn’t have to start in the C-Suite or Board room.

Let’s break it down in relation to a typical environmental program manager. As a program manager, you can start ESG implementation at the department level. As you build momentum, you will have a solid business case to influence senior management for more formal adoption throughout your organization.

Environmental Efforts

Focusing on environmental considerations for a moment, applying the “E” in ESG can help cut costs by limiting and customizing energy use to meet your specific needs and eliminating regulatory fines born from improper waste discharge, greenhouse gas emissions, or overuse of groundwater. Because the ESG principles are fully integrated (action in one area will affect outcomes in others), establishing a clear set of environmental criteria by which your company operates will align your corporate view with that of your employees and stakeholders, improving retention of and attracting top talent and investment.

Issues you can address include:

- Energy Management- consumption and conservation efforts

- Fuel Economy- fuel consumption and conservation efforts, impact of fleet, emissions

- Water management- consumption and conservation efforts

- Waste Management- disposal, recycling, reuse of solid and hazardous waste, reduction efforts

- Climate Change- risk assessment and efforts to mitigate impacts of climate change on operations

Social Efforts

The issues around corporate social responsibility focus on investing in employees and connecting with the community in which you live and work. True ESG goes beyond simple protections and provides opportunity for long term growth and development. The rewards of a satisfied, engaged workforce are often associated with higher productivity, lower operating costs, and invaluable brand recognition.

Issues you can address include:

- Employee health and safety- injury rates, hazard identification and mitigation,

- Employee training and education- hours of training per employee, professional and skill development opportunities

- Workforce diversity and engagement- turnover rates, gender and ethnic groups in management and total workforce, employee participation in internal programs and committees

- Community engagement and education relating to your services and operations

Governance

Think of governance as the ground rules for daily operations. The policies, practices, and programs that guide your decisions regarding everything from recruiting and hiring to purchasing and operations. Because the ESG principles are fully integrated, governance provides the foundation on which social and environmental efforts are built. It’s a way of institutionalizing ESG commitment and ensuring consistency over time.

Issues you can address include:

- Materials sourcing and supply chain management- vendor qualification, local sourcing, diversified business enterprise partnerships

- Ethics policies and programs

- Hiring and promotion practices

- Regulatory compliance- infractions, penalties, and fines assessed

Case Study in ESG for Environmental Managers

Hargis + Associates (Hargis) has been in the environmental consulting business for more than 40 years—navigating the evolving environmental regulatory grid, developing and implementing meaningful and impactful environmental management plans, investigating and remediating past environmental impacts to limit liabilities, and identifying and preventing future environmental impacts for risk mitigation.

Recently, Hargis helped a client contribute to established corporate environmental goals by finalizing the remediation and rehabilitation of 43 acres of impacted industrial land, meeting state and federal cleanup requirements. By using in situ remedial solutions for soil and soil gas and monitored natural attenuation as the groundwater remedy, Hargis was able to limit greenhouse gas emissions, waste water discharged, and impacted soil exported to landfills during the remedial process.

The client achieved:

- Zero regulatory fines or stop work orders;

- Regulatory agreement with remediation results with very limited land use covenant requirements;

- Conformed to CEQA emission guidelines during remedial activities including work with on-site heavy equipment, waste hauling, and emissions from the on-site soil treatment remedy.

- Diversification and strengthening of the supply chain by contracting with Hargis, a certified small business, and

- The sale of the property within internal fiscal timelines to minimize tax liabilities.

The property was successfully redeveloped as a distribution and warehouse center incorporating environmental considerations in the planning and building processes. Finally, Hargis developed an environmental management plan to help the new developer navigate any potential environmental and regulatory complications encountered when developing recently remediated land.

Learn more about this project: RCRA Closure at a Former Manufacturing Facility

How to Get Started with ESG

ESG has become an important consideration in for organizations and their stakeholders. It’s a complex concept with interrelated issues and impacts. But the rewards are worth the effort of implementation.

Wondering how to get started down the path of ESG?

- Get familiar with accepted frameworks like Sustainability Accounting Standards Board (SASB), Global Reporting Initiative (GRI), or the UN Sustainability Development Goals (SDGS).

- Choose the specific issues that are relevant to your organization and its business goals.

- Open channels of communication for stakeholder engagement so you can understand which issues are important to the groups of people that influence or are impacted by your organization.

- Guided by input from your stakeholders, prioritize the ESG issues that will have the greatest potential for positive impact in the near and long term.

- Set goals for each of these issues. Goals should be both qualitative and quantitative and include a timeframe.

- Choose metrics that reflect your progress towards these goals.

- Share your progress regularly with stakeholders. Be transparent and continue the stakeholder engagement process.

- Celebrate your successes and accomplishments. Acknowledge where you fall short and commit to continuous improvement.

If you’d like to learn more about our services and get practical resources specific to your role and industry delivered directly to your inbox, subscribe to The Drop. Each month, the hydrogeology and engineering consultants at Hargis deliver valuable information and insights on environmental and water resources topics relevant to you. Subscribe here

About the Author

Daniel A. Toffelmier, MS

Senior Hydrogeologist

Hargis + Associates, Inc.

dtoffelmier@hargis.com

LinkedIn: https://www.linkedin.com/in/danieltoffelmier/

Dan has professional experience in hydrogeology since 2006 and geophysics since 2002. Dan has provided environmental consulting services including program management and supervision, field investigation management and support, contractor evaluation and procurement, client liaison, data analysis and interpretation, and regulatory oversight communication on projects throughout the southwestern United States. In addition to project management experience, Dan is knowledgeable in the application of a wide variety of media collection and monitoring techniques including those used for the surface and subsurface investigations of soil, soil gas, indoor air, groundwater, and industrial materials. Dan is also experienced in the interpretation, remediation, and application of regulatory guidelines for numerous impacts to environmental media including VOCs, PCBs (TSCA), DNAPL, metals, pesticides, dioxins, and hydrocarbons. Dan is also experienced in lithologic logging (USCS), well construction and development, aquifer testing and data interpretation using ArcGIS, MAROS, ProUCL, and KT3D-H2O.